Artificial Intelligence (AI) is no longer limited to IT or analytics teams. Today, businesses across all departments—from human resources to marketing to operations—are implementing AI tools to optimize processes and decision-making. While finance departments are no strangers to automation and analytics, they now find themselves influenced by how other teams use AI.

AI adoption in non-financial areas has a significant ripple effect on how financial departments function. Whether it’s improving forecasting, reducing manual errors, or supporting strategic planning, finance professionals increasingly rely on data and predictions coming from other departments. This post explores how AI usage in various business units is transforming financial operations, offering opportunities for enhanced collaboration, efficiency, and smarter decision-making.

AI in HR: Helping Finance Forecast Labor Costs and Planning

Human Resources (HR) is using AI tools to screen candidates, predict turnover, and assess employee performance. These insights generate more than just talent data—they also contribute to financial planning.

When AI helps HR predict the number of hires needed or identifies departments with high turnover risks, it allows the finance department to prepare accurate payroll budgets and recruitment cost projections.

Financial impacts include:

- More accurate salary forecasting: Finance can anticipate changes in compensation due to upcoming promotions, performance-based bonuses, or new hires.

- Optimized hiring budgets: AI-generated hiring needs allow finance to allocate funds more efficiently.

- Planning for attrition: Predictive models help finance plans for training or hiring costs linked to employee turnover.

Instead of waiting for updates from HR, finance teams now gain access to near real-time workforce data, improving agility in financial planning.

AI in Marketing: Enhancing Revenue Predictions and ROI Analysis

Marketing departments use AI to analyze customer behavior, personalize campaigns, and estimate campaign performance. These tools often track customer engagement, sales conversion rates, and retention trends. When this data is shared with finance, it greatly improves revenue forecasting and helps optimize budgeting decisions. For example, if a marketing AI tool forecasts a 20% boost in sales during an upcoming quarter, the finance team can align budgets, adjust cash flow planning, and revisit investment strategies.

AI-driven insights from marketing benefit finance in many ways:

- Campaign ROI measurement: Finance can assess which marketing efforts truly add value and adjust spending accordingly.

- Sales cycle forecasting: Anticipating when and where revenue will come in helps streamline working capital planning.

- Customer lifetime value (CLV): Predicting CLV allows finance to model long-term revenue from specific customer segments.

With access to smarter marketing data, finance departments make more strategic, data-backed decisions.

AI in Operations: Cost Management and Resource Optimization

Operations teams increasingly use AI for supply chain optimization, inventory management, and logistics. These tools monitor real-time activities, detect inefficiencies, and predict future demands or disruptions. Finance teams use this information to understand cost drivers, prepare for potential delays, and avoid unexpected financial impacts. For instance, if AI detects an upcoming supply chain delay due to material shortages, finance can adjust budgets or forecast potential penalties.

Finance teams benefit through:

- Real-time cost tracking: Insights from operations help finance keep tabs on manufacturing or delivery expenses.

- Inventory alignment: Better stock level predictions support more accurate balance sheet management.

- Efficiency gains: Identifying bottlenecks leads to leaner operations, saving money and boosting margins.

Operational AI allows finance teams to transition from reactive planning to proactive strategy.

AI in Customer Service: Supporting Financial Risk Analysis

Customer service departments are also turning to AI—especially chatbots, automated helpdesks, and sentiment analysis tools. These technologies help measure customer satisfaction, response time, and issue resolution rates. The insights gathered here can feed into financial risk assessments, especially when tied to customer churn and refund rates. For subscription-based or product-focused businesses, understanding how customer sentiment affects sales or loyalty is critical for financial modeling.

Key impacts on finance include:

- Predicting churn: If AI signals a drop in customer satisfaction, finance can plan for revenue dips.

- Understanding refund trends: Sentiment analysis may identify patterns leading to product returns, helping adjust revenue recognition models.

- Cost of customer support: Analyzing service performance aids in budgeting for tools, staff, and infrastructure.

Customer-facing data adds an extra layer of intelligence to financial strategy.

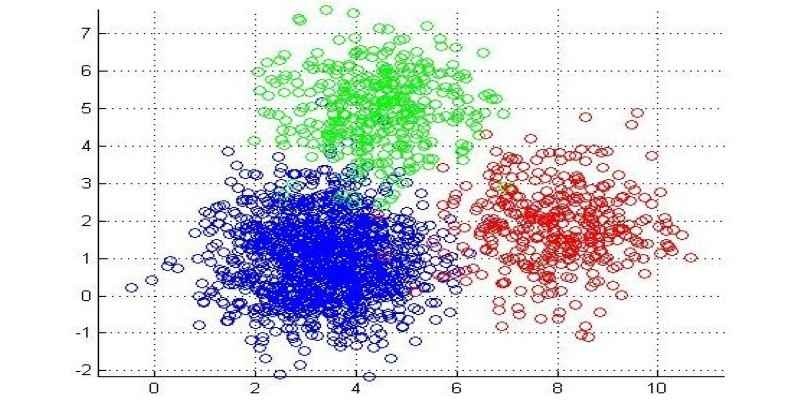

Cross-Department AI: Fostering Financial Collaboration and Alignment

The biggest transformation occurs when AI data flows across departments. Finance professionals no longer work in isolation—they are part of a larger, connected ecosystem. The use of AI in HR, marketing, and operations means finance gains access to real-time insights from multiple business units.

How this alignment benefits finance:

- Integrated forecasting: Data from different teams helps create comprehensive financial models.

- Cross-functional dashboards: Shared AI tools present unified metrics, improving transparency.

- Smarter scenario planning: Finance can simulate multiple business outcomes based on AI-driven inputs from various departments.

When departments collaborate using AI, financial decisions become more accurate, strategic, and aligned with overall business goals.

Risks and Considerations: Staying Cautious with Shared AI Data

While there are major advantages, finance teams must also navigate the risks of relying on AI-generated data from other departments. Misinterpretation, outdated models, or inconsistent data can lead to incorrect financial projections.

Potential risks include:

- Lack of data validation: AI tools may use different assumptions, leading to skewed results.

- Overreliance on predictions: Forecasts can be helpful, but finance should still apply human judgment.

- Data security and compliance: Cross-departmental data sharing must follow privacy regulations, especially when financial or personal data is involved.

Finance teams must treat AI data as a valuable input, not an unquestionable output.

Conclusion

AI is reshaping how businesses operate, and its reach now extends well beyond the finance department. From HR to marketing to operations, AI tools are generating valuable insights that finance teams can use to make more accurate, data-driven decisions. This cross-departmental impact is transforming financial operations—from budgeting and forecasting to risk analysis and strategic planning. However, to fully benefit, finance professionals must build bridges with other teams, ensure data consistency, and approach AI-driven insights with both curiosity and caution.