Artificial Intelligence (AI) is making a significant impact on many industries, and finance is one of the top sectors experiencing its transformative power. What used to be handled entirely by human experts and manual processes is now being enhanced or replaced by intelligent algorithms and machine learning models.

To stay competitive and to offer faster, safer, and more personalized services, financial companies all over the world are turning to AI. Artificial intelligence is changing how money is handled, moved, and kept safe by automating back-end tasks and making investment decisions in real time. Take a look at these 5 amazing ways AI is changing the business world right now.

1. Automating Repetitive Financial Tasks

Routine tasks are being done automatically, which is one of the most obvious effects of AI in finance right now. Accountants, banks, and insurance companies do a lot of tasks that used to need to be done by hand. AI makes it possible to perform these tasks quickly and accurately.

By using robotic process automation (RPA) combined with AI, institutions can now perform tasks like:

- Data entry and record matching

- Transaction categorization

- Invoice processing and approvals

- Generating financial reports

This level of automation reduces the risk of human error, cuts down operational costs, and allows employees to focus on more strategic work. As a result, companies can handle more transactions with fewer resources.

2. Detecting Fraud and Strengthening Security

Fraud has always been a big problem in the financial sector. Most of the time, traditional ways of finding suspicious behavior are based on set rules that might miss new or complex schemes. AI-based fraud spotting is a better way to do things.

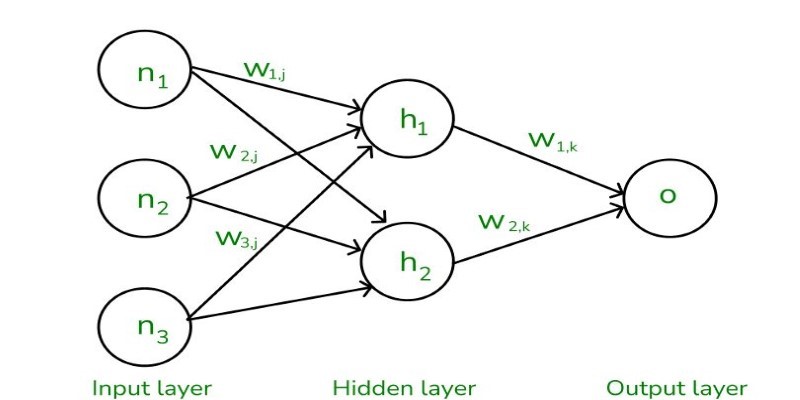

AI models are trained to recognize unusual behavior by analyzing thousands of data points in real time. These systems become smarter over time, learning from previous fraud cases and adjusting their predictions accordingly.

AI-driven fraud detection systems can:

- Identify irregular transaction patterns

- Flag multiple logins from different locations

- Analyze user behavior in real-time

- Block or delay suspicious transactions

This proactive approach allows institutions to detect and respond to threats before damage is done. Many banks and payment platforms now rely on AI as their first line of defense against identity theft, phishing attacks, and transaction fraud.

3. Enabling Smarter Investment Decisions

AI is transforming investment strategies by helping both individuals and institutions make more informed decisions. With vast amounts of financial data available today, it's impossible for human analysts to monitor every variable. That’s where AI comes in.

AI-powered systems can analyze stock trends, economic news, social media sentiment, and historical data to generate insights in seconds. These systems assist traders, fund managers, and even retail investors by suggesting the best possible moves based on the available data.

Common AI applications in investing include:

- Robo-advisors for personal investment management

- Algorithmic trading models that execute trades at optimal times

- Risk profiling and portfolio optimization tools

Robo-advisors, for instance, offer users tailored investment portfolios based on their goals, risk tolerance, and financial situation. It brings professional-level investment services to the average person, often at a much lower cost than traditional advisors.

4. Enhancing Customer Experience and Personalization

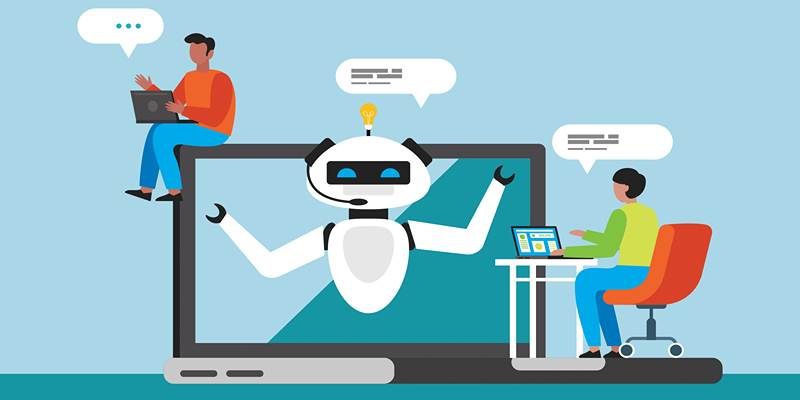

Customer expectations have changed drastically in the digital age. People want instant service, 24/7 support, and personalized financial products. AI helps financial institutions deliver all three.

Chatbots and virtual assistants are some of the most widely used AI tools in customer service. These tools answer questions, guide users through account processes, and even handle basic transactions—without human intervention.

Benefits of AI in customer service:

- Reduced wait times and faster responses

- Consistent service across digital channels

- Personalized product recommendations

In addition to customer support, AI also helps personalize financial offerings. By analyzing transaction history, behavior patterns, and preferences, banks can recommend credit cards, loans, or savings plans that suit each customer’s needs.

5. Supporting Better Risk Management and Forecasting

Risk is an unavoidable part of finance. Whether it's credit risk, market risk, or operational risk, financial institutions must continuously evaluate potential threats to their stability. AI is helping professionals manage and predict risks more effectively than ever before.

AI systems analyze massive amounts of structured and unstructured data—from loan applications to social media mentions—to identify early warning signs. These insights allow institutions to make informed decisions and prepare for potential issues.

AI is used for:

- Credit scoring and risk assessment for loans

- Predicting market volatility using news and economic indicators

- Scenario planning and stress testing

For example, a bank considering a loan application might use an AI tool that evaluates not only the applicant’s credit history but also real-time financial activity and even external market conditions.

Why These Changes Matter

AI is not just making financial processes faster—it’s making them smarter, safer, and more user-friendly. For financial institutions, the advantages are clear:

- Improved efficiency through automation

- Reduced costs by minimizing manual effort

- Stronger security with real-time fraud prevention

- Smarter decision-making with AI insights

- Better customer satisfaction with personalization

At the same time, these changes also benefit customers. Individuals can now access financial advice, open accounts, apply for loans, and receive support—anytime, anywhere, without standing in lines or waiting on hold.

Conclusion

Artificial Intelligence is not replacing finance professionals—it’s enhancing what they can do. By taking over repetitive tasks and analyzing massive data sets, AI is allowing humans to focus on strategy, creativity, and building better customer relationships. The financial sector is expected to invest even more in AI in the coming years, with technologies like natural language processing, deep learning, and predictive analytics leading the way. For any financial institution aiming to stay ahead, understanding and adopting AI is no longer optional—it’s essential