No longer is Artificial Intelligence (AI) just used in tech startups or buying stocks. It is now making big moves into private markets, which have been run by human networks, studies done by hand, and gut feelings for a long time. As more people use AI tools, asset managers, private equity companies, and venture capitalists are rethinking how they work. It's moving quickly now. And people who don't pay attention to this change could be seriously hurt.

What Are Private Markets?

Private markets refer to investments that aren’t traded on public exchanges. These include:

- Private Equity

- Venture capital

- Private debt

- Real estate

- Infrastructure projects

High-quality data has always been hard to get in these areas. It was common to make decisions with little information available, so you needed to know a lot about the business and have a lot of personal connections. AI is now helping to close those gaps by giving us faster, data-driven insights.

Why AI Is Entering Private Markets

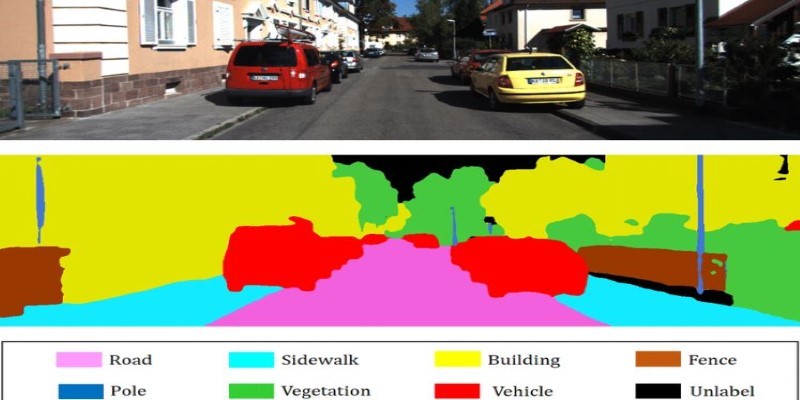

AI is being adopted across industries for its ability to analyze data quickly and accurately. In private markets, this is especially valuable. Firms face growing volumes of complex, unstructured data—financial records, market reports, legal documents, and even social media trends. Human teams struggle to process all this information in time to act on it. AI steps in to automate and enhance the decision-making process.

Key Drivers Behind the Shift

Several factors are fueling the adoption of AI in private markets:

- Increased data availability: More digital records, more potential insights

- Pressure for faster decisions: Markets move quickly; delays can be costly

- Rising competition: Firms want an edge to identify deals early

- Desire for accuracy: Mistakes in due diligence or valuation can be expensive

AI is seen not just as a tech upgrade but as a strategic tool.

Practical Uses of AI in Private Markets

AI is being applied across every stage of the private market investment cycle.

Deal Sourcing

Firms are using AI to scan thousands of startups, companies, and industries in real-time. The technology filters opportunities based on custom criteria—such as financial growth, market position, or leadership changes. For example, a venture capital firm might use AI to identify early-stage fintech companies in Latin America showing unusual digital traction.

Due Diligence

AI tools can process legal contracts, customer data, and financial statements in minutes rather than weeks. They highlight inconsistencies, flag risk indicators, and generate summaries that help teams make faster decisions. This automation not only reduces errors but also lowers due diligence costs.

Portfolio Monitoring

AI-powered dashboards can track a firm’s entire portfolio, sending alerts for unusual activities or performance shifts. Predictive analytics helps identify when a company might need support—or when it’s ready for an exit.

Forecasting and Trend Analysis

AI algorithms can predict market changes by analyzing macroeconomic indicators, consumer behavior, or sector-specific trends. It supports smarter long-term investment strategies.

Benefits of AI for Private Market Firms

The adoption of AI in private markets comes with several clear advantages:

- Faster deal identification

- Stronger due diligence with fewer human errors

- Automated tracking and real-time alerts

- Better forecasting for exits or follow-up funding

- Improved operational efficiency across teams

These benefits translate into competitive advantages. Firms that leverage AI tools are often able to respond faster, take better risks, and deliver more value to their investors.

Challenges Slowing Adoption

While AI offers many benefits, adoption in private markets hasn’t been universal. Several roadblocks exist.

Limited Data Standardization

Private markets lack the structured reporting formats common in public markets. AI systems often struggle to read and compare data that varies from one deal to another.

Data Privacy Concerns

Many firms handle sensitive financial and legal data. There is hesitation around uploading that information into cloud-based AI platforms, especially those from third-party providers.

High Learning Curve

AI tools require technical understanding and change management. Teams may be resistant to learning new platforms or adapting their workflows. Still, firms that start small and scale over time are seeing meaningful results.

AI Tools Already Shaping the Industry

Several platforms are leading the charge in artificial intelligence investing:

- Palico – AI-driven fund matchmaking platform

- DiligenceVault – Automates due diligence processes

- Preqin – Provides predictive analytics and market insights

- Grata – AI-powered search tool for deal sourcing

- DataRobot – Builds custom AI models for finance

These tools offer different features, but they share a common goal: helping private market firms work smarter and faster.

The Human Element Still Matters

Despite AI’s advantages, it is not replacing human judgment. Instead, it is enhancing it. Relationships, negotiation, and instinct remain key in private market transactions. However, AI allows human professionals to focus more on strategy and less on spreadsheets. It serves as a co-pilot—not a replacement. Firms combining human insight with AI efficiency are proving to be the most successful in today’s landscape.

What Firms Should Do Next

To avoid being left behind, firms should take these steps now:

- Educate teams on what AI can and can’t do

- Identify low-risk areas where AI can be tested (e.g., data scraping, reporting)

- Partner with AI vendors offering finance-specific solutions

- Start small and expand based on measurable outcomes

- Invest in talent that can bridge the gap between finance and data science

Early adoption can build internal confidence and lead to long-term cost savings.

Conclusion

AI is rapidly transforming private markets by offering faster decision-making, improved accuracy, and smarter investment insights. Firms that embrace AI early are gaining a competitive edge, especially in sourcing deals and managing portfolios efficiently. From streamlining due diligence to enhancing forecasting, AI is reshaping every stage of the private investment process. However, its true potential is realized when combined with human expertise and strategic judgment. Ignoring this shift could lead to missed opportunities and slower growth.