In the fast-evolving landscape of private equity, secondaries have emerged as a critical area for investors seeking liquidity and flexibility. With the growth of data and the increasing complexity of deals, firms are now exploring the use of artificial intelligence (AI) to gain a competitive edge in secondary private equity transactions.

By adopting AI-powered tools, private equity firms can automate tasks, improve deal flow, and enhance decision-making processes. This post explores how AI is transforming secondaries, what benefits it offers, and what challenges remain in its adoption.

Understanding Secondaries in Private Equity

Secondaries refer to transactions involving the buying or selling of existing investor commitments in private equity funds. Rather than waiting for a fund’s lifecycle to conclude, investors can use the secondary market to exit early or acquire stakes in mature funds.

There are two primary types of secondary transactions:

- LP-led secondaries: Involve the sale of fund interests by limited partners (LPs) to other investors.

- GP-led secondaries: Include fund restructurings or continuation vehicles initiated by general partners (GPs), offering existing investors an option to exit or roll over.

Multiple parties, deep fund data, and unique valuation problems make these deals very complicated. Here's where AI can make a real difference: in complicated situations.

The Role of AI in Secondaries

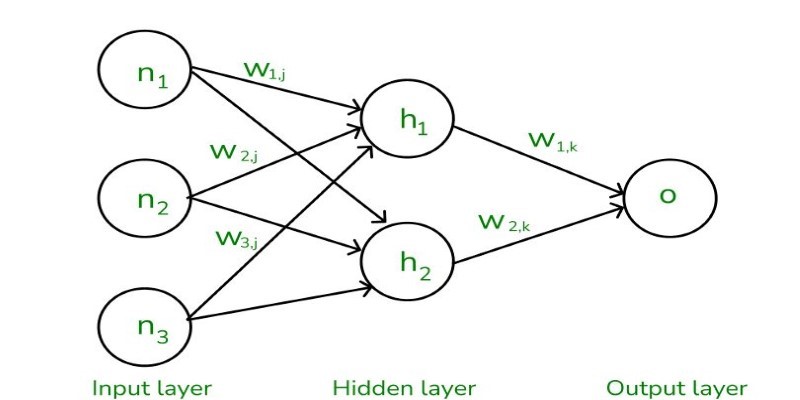

Machine learning and natural language processing are two types of AI that are being used more and more in different parts of private equity deals. With these tools, secondary schools can make choices faster, with less work done by hand, and with higher accuracy. Firms that use AI in secondary tasks are getting better at things like finding deals, valuing them, analyzing risks, and keeping an eye on their portfolios.

Deal Sourcing and Intelligence Gathering

Identifying promising secondary opportunities requires access to a broad range of data sources. AI tools can scan public and proprietary datasets to spot trends, assess fund performance, and flag high-potential opportunities.

AI supports deal sourcing by:

- Aggregating historical transaction data

- Monitoring fund performance metrics

- Analyzing investor behavior and fund manager activities

- Predicting capital calls and liquidity events

By automating these steps, firms can identify deals that align with their investment strategy much faster than traditional methods.

Enhancing Due Diligence with AI

Due diligence in secondaries often requires deep dives into fund documentation, past performance reports, and legal structures. AI can streamline this process by extracting key information, identifying anomalies, and summarizing critical risks.

Key due diligence tasks supported by AI include:

- Parsing legal agreements for hidden clauses or risks

- Reviewing financial statements and fund NAVs

- Cross-referencing historical fund performance

- Evaluating consistency between fund documents and actual results

It accelerates the analysis process while ensuring important details are not missed.

Valuation and Risk Modeling

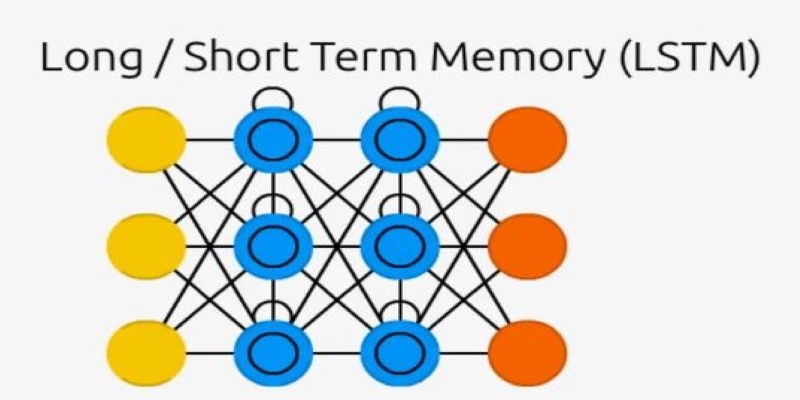

Accurate valuation is essential in secondary transactions, particularly when dealing with illiquid assets or continuation funds. AI models can use historical data, market conditions, and macroeconomic trends to predict fair value more precisely.

These models can also forecast risk by analyzing past fund behavior and simulating different future scenarios. For example, they may assess how a portfolio might perform under a recession or interest rate change.

Ongoing Portfolio Monitoring and Optimization

Once a secondary transaction is complete, AI continues to play a role in monitoring performance. Real-time data from portfolio companies can be collected and analyzed to detect early signs of underperformance or emerging opportunities.

AI-based monitoring tools allow private equity teams to:

- Track key performance indicators across portfolio companies

- Optimize liquidity planning

- Benchmark fund performance against peers

This real-time visibility helps investors take proactive measures to protect or enhance returns.

Benefits of Using AI in Secondaries

Integrating AI in the secondary market offers multiple advantages, especially for firms handling high volumes of data or complex fund structures.

Some notable benefits include:

- Speed: Automates time-consuming tasks like sourcing and due diligence

- Scalability: Enables firms to handle more deals with the same resources

- Deeper insights: Uncovers patterns that humans may overlook

- Cost efficiency: Saves money by streamlining operations

These benefits translate into better deal selection, reduced risk, and stronger portfolio performance.

Challenges in AI Adoption

Despite its potential, AI adoption in private equity secondaries does not come without challenges.

Some of the main hurdles include:

- Data quality: Private equity data is often unstructured or incomplete

- Model transparency: Some AI tools function as “black boxes,” making it hard to explain decisions to stakeholders

- Talent gap: Firms may lack in-house AI expertise or need to partner with external vendors

- Regulatory risks: The use of AI in financial services is still being scrutinized by regulators, especially regarding fairness and accountability

Overcoming these barriers requires thoughtful integration, data governance, and a balance between AI automation and human judgment.

Future Outlook: AI’s Growing Role in Secondaries

As AI tools continue to evolve, their role in secondaries is expected to expand. The industry is moving toward a more data-driven model, where investment decisions are informed by both human experience and machine intelligence.

Key future trends include:

- Predictive analytics for fund liquidity planning

- AI-driven secondary market platforms and exchanges

- Deeper use of alternative data sources (e.g., social sentiment, ESG metrics)

Firms that embrace these technologies early will likely have a competitive edge in sourcing better deals, managing risk more effectively, and generating stronger returns.

Conclusion

The secondary market has become an essential part of private equity, offering flexibility, liquidity, and new growth opportunities. By leveraging AI, firms can enhance every stage of a secondary transaction—from sourcing and valuation to monitoring and optimization. While challenges like data quality and model transparency remain, the advantages of adopting AI tools in private equity transactions are clear. As the market matures, AI will become not just a value-add but a necessity for firms looking to stay ahead. In an increasingly competitive environment, those who invest in intelligent tools will be better positioned to navigate complexity, make faster decisions, and unlock greater value from secondaries.