Artificial intelligence is changing the way you live, work, and even how you handle money. In the world of finance, one question keeps coming up — is there a killer AI app that’s truly making a difference right now? The short answer? Yes.

Some apps really use AI to solve real problems for regular people, even though a lot of them say they do. One amazing app is changing how people handle their money, invest, and make better money choices, and it does all of this with ease and power. This post will talk about what makes this AI app so powerful and why it could be the future of money.

What Makes a Finance App “Killer”?

To be considered a “killer app” in finance, an AI tool must do more than just track spending. It needs to:

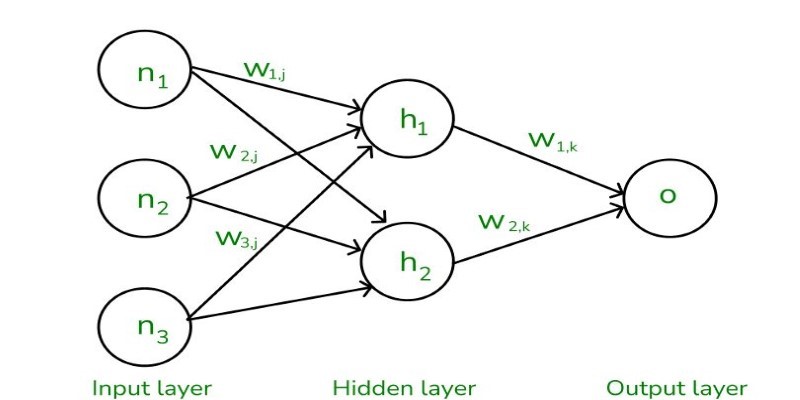

- Understand user behavior over time

- Offer real-time insights, not just historical reports

- Learn and improve based on individual usage

- Be easy enough for anyone to use, even with no financial background

And most importantly, it must solve an actual problem — not just look fancy.

Meet the AI App That’s Leading the Pack

Let's say the name of this app is FinBot, and it's an AI finance assistant that is friendly and does everything. FinBot isn't just another tool for making a budget. The best parts of personal banking, investing, and automating savings are all in one easy-to-use platform. Here’s how:

Smart Budgeting That Adapts

Unlike regular budgeting tools that require you to manually set limits, FinBot learns from your habits. It adjusts your categories, notices patterns (like overspending on weekends), and gives gentle nudges when you're going off-track.

AI-Driven Investing Suggestions

Whether you’re a beginner or an experienced investor, FinBot helps you build a smart portfolio based on your goals, risk level, and market conditions.

- Recommends diversified portfolios

- Monitors market trends

- Suggests when to rebalance based on changes in your life or the economy

It’s like having a financial advisor that never sleeps.

Automated Savings Without Thinking

One of the best features? Automatic savings. FinBot quietly analyzes your income and spending, then moves small amounts into savings when it knows you won’t miss the money. Over time, this adds up — and you don’t even feel the pinch.

Why This AI App Stands Out from the Rest

There are dozens of financial apps out there. But what sets FinBot (or a similar real-world app) apart?

Personalized, Not Generic

Every user has a unique financial situation. Instead of giving generic advice, FinBot learns about you — your habits, your income, your goals — and offers suggestions that actually make sense.

Real-Time Alerts That Matter

Most finance apps send updates like “You spent $60 on food today.” FinBot goes a step further. It might say:

“Your food spending this week is 30% higher than usual — want help adjusting your budget?” Or “You have an upcoming bill due in 3 days — but your current balance may not cover it. Want to move money from savings?” These types of alerts help prevent financial stress before it starts.

Friendly and Easy to Use

FinBot speaks your language. No confusing terms like “equity ratios” or “APR.”

Instead, it explains things clearly, like:

- “If you skip your daily $5 coffee, you could save $1,800 a year.”

- “Putting $200/month into this fund could grow to $10,000 in 3 years.”

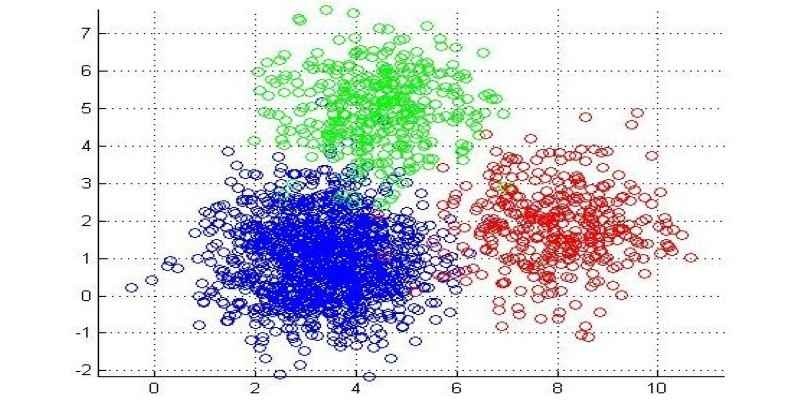

The app also uses visual charts, emojis, and plain text explanations — making finance less scary.

Real-Life Benefits of Using a Finance AI App

People using AI-powered finance tools report a variety of benefits:

- Less stress over money

- More consistent savings habits

- Improved financial knowledge over time

- Confidence in long-term planning

These apps aren’t just for budgeting — they help people feel in control of their financial future.

Who Can Use This Type of AI App?

One of the best things about modern AI finance tools is how accessible they are. You don’t need to be rich, tech-savvy, or have financial experience.

They’re ideal for:

- Students trying to budget for the first time

- Young professionals who want to start investing

- Parents saving for kids’ education

- Retirees tracking their fixed income and expenses

Whether you’re 18 or 80, AI finance tools like FinBot make money management simpler and smarter.

Final Thoughts: Is It Really a “Killer” App?

Yes — because it changes behavior in a lasting way.

It’s not about flashy features. It’s about:

- Saving money without stress

- Making smarter financial decisions

- Avoiding debt before it builds up

- Building long-term wealth automatically

The real killer feature is how it empowers people. With the right AI app, you don’t just manage money — you build a better financial future, one smart step at a time.

What to Look for If You’re Trying One

If you're ready to try an AI-powered finance app, here’s what to check:

- Privacy and security: Make sure your data is safe.

- Customization: Does the app let you adjust your goals?

- Ease of use: Look for a clean design and simple explanations.

- Genuine AI features: Not just automation, but actual learning and insights.

The goal isn’t to replace human judgment — it’s to enhance it with smarter tools.

Conclusion

This AI finance app is transforming the way people manage money by offering real-time, personalized guidance. It goes far beyond traditional budgeting tools, helping users save automatically, invest wisely, and make smarter decisions with ease. By learning from individual habits and adapting to life’s changes, the app provides support that fits each user’s unique financial journey. Its simple, user-friendly design makes it accessible to everyone, regardless of age or financial background. With intelligent features like goal-based saving and portfolio suggestions, it builds confidence and consistency over time.