The private capital industry, long known for its reliance on traditional methods and human judgment, is now undergoing a quiet but significant transformation. Artificial intelligence (AI) is stepping in—not to replace people—but to enhance the way decisions are made, risks are assessed, and portfolios are managed.

In 2025, AI is no longer just a buzzword. It has evolved into a powerful toolkit that is revolutionizing how firms engage with alternative investments, improve performance, and meet the growing expectations of investors. This shift is not just about speed and scale—it’s about smarter, data-driven strategies that create real value.

Why AI Matters in the Private Capital Landscape

Private capital includes private equity, venture capital, private debt, infrastructure, and real estate—asset classes that are less liquid, data-heavy, and typically slower-moving than public markets. Historically, decisions in this space have been based on experience, personal networks, and manual analysis of financials.

In 2025, firms are embracing AI because it helps address core challenges:

- Limited transparency and fragmented data

- Time-consuming deal sourcing and due diligence

- Reactive, rather than proactive, portfolio management

- Inefficient reporting and back-office operations

By integrating AI, private capital managers can become more agile, more informed, and more competitive.

Smarter Deal Sourcing with AI

In traditional settings, finding quality investment opportunities could take weeks or even months. Analysts would manually filter through hundreds of startups, properties, or private companies to find ones that fit the fund’s thesis.

Now, AI platforms are streamlining this process by scanning thousands of data points—company financials, market activity, industry trends, patent filings, and even social sentiment—AI tools identify high-potential opportunities within minutes.

This smart sourcing allows firms to:

- Discover deals ahead of competitors

- Reduce the burden of manual research

- Match opportunities with strategic goals faster

AI is not just searching for keywords—it’s learning from past successes and continuously improving its recommendations.

Enhanced Due Diligence and Risk Analysis

Once a deal is on the table, due diligence becomes the next hurdle. Here, AI plays a crucial role by rapidly assessing a target’s financial health, legal standing, and operational risks using structured and unstructured data.

These tools dive deeper than spreadsheets:

- AI models evaluate management behavior by analyzing digital footprints

- Natural language processing scans contracts and documents for red flags

- Algorithms estimate market size, growth, and future demand

It allows fund managers to make more confident decisions while reducing human bias and blind spots. In a high-stakes environment, that speed and accuracy can make all the difference.

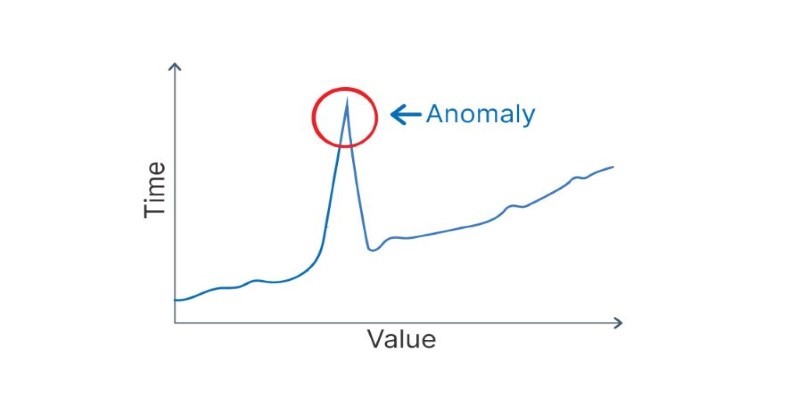

Predictive Portfolio Management in Action

Managing a portfolio of private assets requires constant monitoring. In the past, much of this was done through quarterly reports, lagging indicators, and gut instinct. In 2025, AI will shift this dynamic entirely. AI now enables predictive portfolio management—where software models analyze real-time inputs and economic signals to forecast the future health of each investment.

With this approach, firms can:

- Detect early warning signs of underperformance

- Forecast exit timing and capital needs

- Reallocate funds dynamically to optimize returns

Private capital managers are no longer guessing what might happen—they are seeing it unfold in real-time.

Personalized LP Communication and Fundraising

AI is also helping managers build stronger relationships with Limited Partners (LPs). By analyzing LP preferences, behaviors, and past investments, AI-driven CRM systems provide a more tailored and efficient fundraising experience.

This results in:

- Better-targeted outreach strategies

- Higher LP retention and satisfaction

- Clear, real-time performance dashboards for transparency

In an industry where trust is everything, this level of personalized communication helps build lasting investor confidence.

Automating the Back Office

While front-end innovation gets the spotlight, AI is also quietly revolutionizing the back office. Administrative tasks—compliance tracking, accounting, document filing—once required hours of manual labor. AI now automates much of this work.

Common tasks enhanced by AI include:

- Real-time data entry and reconciliation

- Auto-generated compliance reports

- Instant portfolio updates with smart tagging systems

This efficiency reduces operational costs, minimizes errors, and allows teams to focus on high-value tasks like strategy and growth planning.

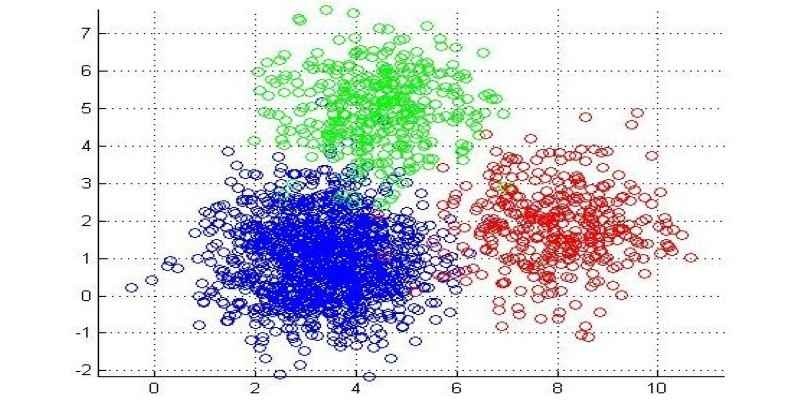

Tapping into Alternative Data for Investment Edge

One of AI’s greatest contributions is its ability to extract insight from “alternative data.” It includes satellite images, app usage statistics, credit card data, foot traffic, and even online reviews—data that was previously ignored or inaccessible.

In private capital, these new data sources offer a unique edge:

- Real estate firms use satellite images to track construction progress

- Venture capital firms analyze social buzz and hiring trends to assess startup momentum

- Private equity firms monitor supplier activity and product reviews for early signs of change

AI transforms this chaotic data into actionable signals, helping firms gain a first-mover advantage in their sectors.

Challenges and Considerations

Despite the excitement, integrating AI into private capital comes with real considerations.

- Data privacy: Sensitive information must be handled with care.

- Model transparency: Not all decision-makers are comfortable relying on “black-box” algorithms.

- Talent gaps: The industry needs people who understand both finance and machine learning.

- Regulatory compliance: Firms must ensure that AI tools follow evolving legal standards.

Adoption must be done thoughtfully, with clear strategies and human oversight.

Conclusion

In 2025, AI is not just enhancing private capital—it’s transforming it. From deal sourcing to risk analysis, from back-office automation to personalized LP engagement, AI is making every part of the process faster, smarter, and more reliable. Firms that embrace AI gain not only a technological edge but also the ability to create long-term value for investors and stakeholders. As the private capital landscape grows more competitive, the role of AI will only continue to expand—reshaping the future of finance one algorithm at a time.